How to Optimise your Payroll Process

Identifying and improving the manual processes in your payroll process will result in a more accurate and efficient service. Payroll is a critical operation in any business, as we all know. Any mistake has a significant impact on employees’ life, resulting in low morale and a lack of confidence. As a result, whether you perform payroll in-house or outsource it, it must be done correctly. This isn’t always as simple as you may believe; there are several rules and regulations to consider, as well as various sorts of employment contracts and perks to consider.

In this article, we’ll look at some of the most common mistakes people make and offer suggestions for assessing and improving your processes. In addition, we give a free payroll process template to assist in identifying manual procedures and resolving issues in your process.

Changes are made infrequently.

Infrequent change may appear to be beneficial, but only if you remember to keep track of it! The contract for each employee, the hours they work, how much they are paid, how many holidays they get, and the perks they receive all go into payroll. These are rarely altered, and they usually do so at the same time each year after an annual review. As a result, it’s frequently up to individual Line Managers to keep track of, organise, and then communicate changes to HR. These procedures take time and increase the risk of information being lost or mistakenly inputted.

Look for systems that are integrated into the same HR and payroll system and urge line managers to do reviews and enter changes right away. This results in a more coordinated approach between the line manager and HR, as well as time savings from duplication.

Changes that are just temporary

This is likely the most prone to errors, and it necessitates regular and time-consuming corrections. Overtime, bonuses, leave, and other one-time charges that can affect an employee’s income are examples of temporary modifications. These changes, however, vary month to month and frequently rely on self-reporting. Furthermore, such modifications are usually reported by hand or documented using spreadsheets.

Look for any processes in which people are exchanging spreadsheets. Multiple spreadsheets can easily become jumbled up, resulting in incorrect data being submitted and reported. Examine ways to connect the many systems that the data relies on, and examine whether automation could be the solution to your problems.

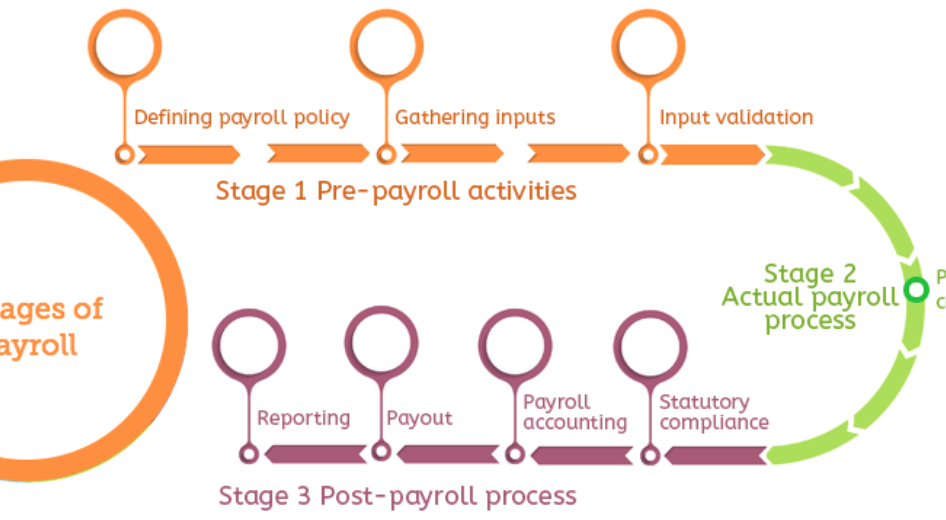

Payroll Processing

You can look at the computations once you have all of the information. Consider payroll solutions that allow you to enter all contract details and tax rates in order to generate the correct payroll. In this stage of the procedure, there are usually numerous approval points. Look for a workflow that notifies the approver automatically and records what and when they approved it. Examine which portions of the procedure are done by hand and replace them with an automated payment service.

Payments to non-employees

Finally, you must file reports with the tax authority and third-party service providers. Instead of manually uploading to many supplier websites, see if your payroll system can interact with them. If you don’t have access to a portal, a robot (robotic process automation) can log in and upload on your behalf.

Conclusion

It’s apparent that there are numerous ways to increase payroll’s efficiency and quality of work. Begin by defining and discussing the process with the members of your team who carry it out on a daily basis. Use their knowledge and experience to figure out where all the physical labour takes place, and then search for ways to cut down on waste and errors. It’s critical to keep the team involved throughout the process and to utilize a process map to clearly communicate the issues you’ve discovered and how to solve them.